Roughrider

Roughrider

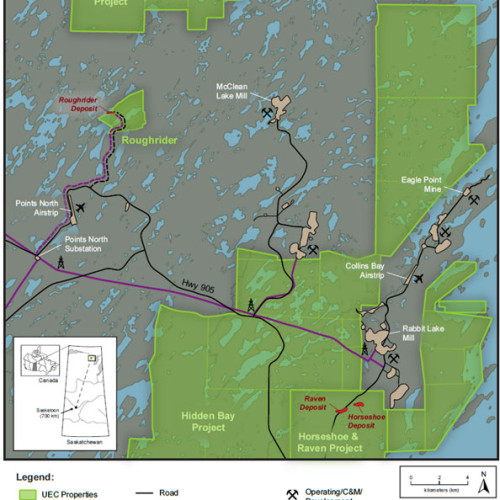

The Roughrider Project (“the Project”) is an exploration-stage conventional uranium project located in the eastern Athabasca Basin of northern Saskatchewan, Canada. The Project is located approximately 13 km west of Orano’s McClean Lake Mill and covers an area of approximately 598 hectares. The Project is near UEC’s other existing eastern Athabasca Basin properties in the McClean Lake/Rabbit Lake area. The Roughrider Project was the flagship asset of Hathor Exploration Ltd., which Rio Tinto acquired for US$550 million. On October 17, 2022, UEC completed the acquisition of 100% of the project from a subsidiary of Rio Tinto plc for a total acquisition cost of $150M US dollars in cash and shares. (1)

UEC filed an initial assessment technical report summary on November 8th, 2024 that included an economic analysis and mineral resource estimate for the Roughrider Project. Key competitive advantages that position Roughrider as an elite underground development project include:(2)

- High grade operation with 2.36% U3O8 Life of Mine ("LOM") feed grade

- One of the lowest capex profiles in Canada and

- Located in the Eastern Athabasca Basin, where future development will benefit from proximity to power, roads, and the Points North Landing airport and construction facility.

- Estimated post-tax NPV8 of $946 million, IRR of 40%, post-tax payback period of 1.4 years based on a long-term uranium price of $85/lb U3O8 and utilizing an 8% discount rate (NPV 8%). See Table 1.

- Expected Life of Mine (“LOM”) production of 61.2 million pounds U3O8 produced over nine years with an average annual production rate of 6.8 million lbs U3O8. Initial capex estimated at $545 million including mill and underground mine. See Table 2.

- All In Sustaining Cost ("AISC") of $20.48/lb U3O8. See Table 3.

Table 1. Base Case Financial Highlights

| Base Case Financials | ||

| Pre-Tax Cash Flow (undiscounted) | ($ millions) | $3,366 |

| Pre-Tax NPV8 | ($ millions) | $1,629 |

| Pre-Tax IRR | % | 53% |

| Pre-Tax Payback Period | Years | 1.2 |

| Post-Tax Cash Flow | ($ millions) | $2,040 |

| Post-Tax NPV8 | ($ millions) | $946 |

| Post-Tax IRR | % | 40% |

| Post-Tax Payback Period | Years | 1.4 |

Table 2. Key Physical Highlights

| Initial Assessment Report Physical Highlights | ||

| Avg. LOM Annual Production | M lbs U3O8 | 6.8 |

| LOM Production | M lbs U3O8 | 61.2 |

| Mine Life | Years | 9 |

| Mill Processing rate | tonnes / day | 400 |

| Underground peak mining rate | tonnes / day | 818 |

| LOM tonnes processed | tonnes | 1,205,000 |

| LOM Avg. Head Grade | %U3O8 | 2.36 |

| Process Recovery | % | 97.5 |

Table 3. Cost Summary

*Note: totals may not add due to rounding.

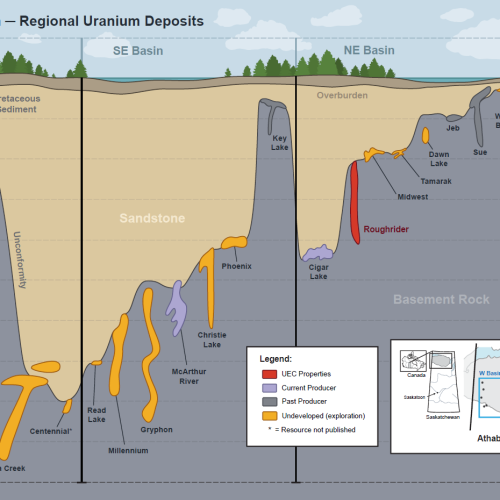

The Roughrider Project was first explored by Hathor in 2007. Following the discovery of Roughrider in 2008, Hathor drilled approximately 143,414 m of drilling in 389 holes before filing a PEA Technical Report in October of 2011 that included the Roughrider East Zone and Roughrider West Zone. After acquiring the Roughrider Project, Rio Tinto continued to advance the project, completing substantial pre-development and environmental baseline work including dedicated geotechnical drilling, shaft vs. decline modelling, the establishment of hydrogeological monitor wells, terrestrial and aquatic environmental assessments, heritage assessments, species at risk, and a conceptual reclamation plan. In July of 2013, Rio Tinto submitted an Advanced Exploration Program (“ADEX”) proposal for consideration to the Saskatchewan Ministry of Environment. The program was intended to initiate EIS review of the project, with the project intended to provide direct data related to the ore and mine development design. The application was partially through the EIS review process, but no official determination was completed. (2)

There are over 20 uranium deposits, four current and historically producing mines, and two uranium mills within 100 km of Roughrider, providing excellent infrastructure for future development, including all-weather road infrastructure, an all-weather airstrip within six km, and robust electrical grid access, primarily generated from renewable hydroelectric sources. (3)

1 News release dated October 17, 2022, available under UEC’s filings on EDGAR and SEDAR.

2 News release dated November 8. 2024, available under UEC’s filings on EDGAR and SEDAR

3 Saskatchewan Environment Publication 2013-014, “Rio Tinto – Roughrider Advanced Exploration Program”, accessible athttps://publications.saskatchewan.ca/#/categories/115

4 Cameco Corporation 2021 ESG Report, SaskPower System Map accessible at https://www.saskpower.com

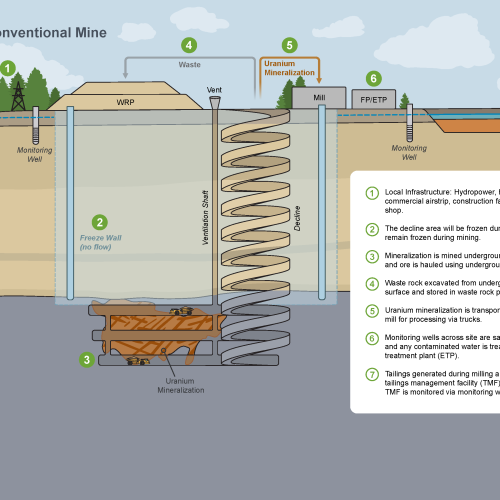

The Roughrider deposit is an unconformity‐associated deposit characterized by pitchblende veins and semi‐massive replacements occurring in three zones, the West (“RRW”), East (“RRE”), and Far East (“RRFE”). The deposit is associated with the basal unconformity contact between Proterozoic sandstone of the Athabasca Group and basement rocks of the Wollaston Group. The basement rocks associated with Roughrider Project are interpreted as the basal part of the Wollaston Group, with garnet‐ and cordierite‐bearing pelitic gneiss, minor graphitic pelitic gneiss, psammopelitic to psammitic gneiss, and rare garnetite. The Wollaston Group rocks are interfingered with Archean felsic gneiss and later Proterozoic intrusive rocks. The unconformity is approximately 240 m below the surface in the Project area.

The focus of the Roughrider Project is the three mineralized areas, the RRW, RRE and RRFE. The Roughrider West Zone was discovered in February 2008, with uranium mineralization that grades 5.29% U3O8 over 11.9 m in drill hole MWNE‐08‐12. The RRE zone was discovered in September 2009 with the best intersection on the property that grades 7.75% U3O8 over 63.5 metres. The RRFE zone was discovered in February 2011 with mineralization in MWNE‐11‐698 with an average grade of 3.26% U3O8 over 42.8 metres.

The zones of uranium mineralization at the Project vary in size and depth below the unconformity:

- RRW - is 200 m long and up to 50 m wide, and occurs at the unconformity down to approximately 50 m below the unconformity;

- RRE - is 100 m long and up to 50 m wide, and occurs from 20 m below the unconformity down to approximately 120 m below the unconformity; and

- RRFE - is 75 m long and up to 50 m wide, and occurs from 100 m below the unconformity down to approximately 220 m below the unconformity.

Uranium mineralization at Roughrider is mono‐metallic and occurs as stacked parallel lenses separated by intervals of barren or weakly mineralized host rock (less than 0.5% U3O8), it has a moderate plunge to the north‐east in the basement rocks. The mineralization is highly variable in thickness and style, with high grade mineralization occurring as medium‐ to coarse‐grained, semi-massive to massive pitchblende.

The 2024 mineral resource estimate that is set out in the Technical Report Summary has been prepared in accordance with the requirements of S-K 1300. To meet the requirement of reasonable prospects of eventual economic extraction, the mineral resource estimate is reported within a constrained mineable shape optimizer as informed by a breakeven cut-off grade of 0.30% U3O8. The mineral resource estimate is reported diluted, including waste and mineralization below cut-off.

The mineral resource estimate set forth in the Technical Report Summary is summarized in Table 1. No Mineral Reserves have been estimated at the project.

Table 1: Mineral Resource Statement for the Project (as of November 5, 2024)

| Zone | Classification | Tonnage (kt) |

Grade U3O8 (%) |

Contained U3O8 Metal (M lb U3O8) |

| RRW | Indicated | 431 | 1.89 | 17.97 |

| Inferred | 152 | 2.80 | 9.39 | |

| RRE | Indicated | - | - | - |

| Inferred | 390 | 2.57 | 22.05 | |

| RRFE | Indicated | 268 | 1.67 | 9.89 |

| Inferred | 78 | 1.13 | 1.94 | |

| Total | Indicated | 699 | 1.81 | 27.86 |

| Inferred | 620 | 2.45 | 33.38 |

Notes

- Reported on a 100% ownership basis.

- To establish reasonable prospects of eventual economic extraction, a cut-off grade of 0.30% U3O8 was utilized. Such grade was calculated based on the following criteria and assumptions U3O8 price of $85 / lb, transport cost of $0.26 / lb, mining cost of $163 /t, processing cost of $222 / t, G&A cost of $112 / t, royalties of 9.22% / t, and process recovery of 95.5%.

- The mineral resource estimate was prepared by Understood Mineral Resources Ltd., one of the independent qualified persons under the Technical Report Summary. The MSO shapes were estimated by Snowden Optiro, one of the independent qualified persons under the Technical Report Summary.

- The tonnage is presented in metric tonnes and contained metal is reported in both metric tonnes and imperial pounds. Estimates have been rounded and may not add up due to significant figure rounding.

Canada Careers

| Position | Location | Description |

|---|---|---|

| District Geologist Posting Saskatchewan | Saskatchewan | |

| Junior Geologist Posting Saskatchewan | Saskatchewan |

To apply for any of the above positions, send your resume and qualifications to: [email protected].